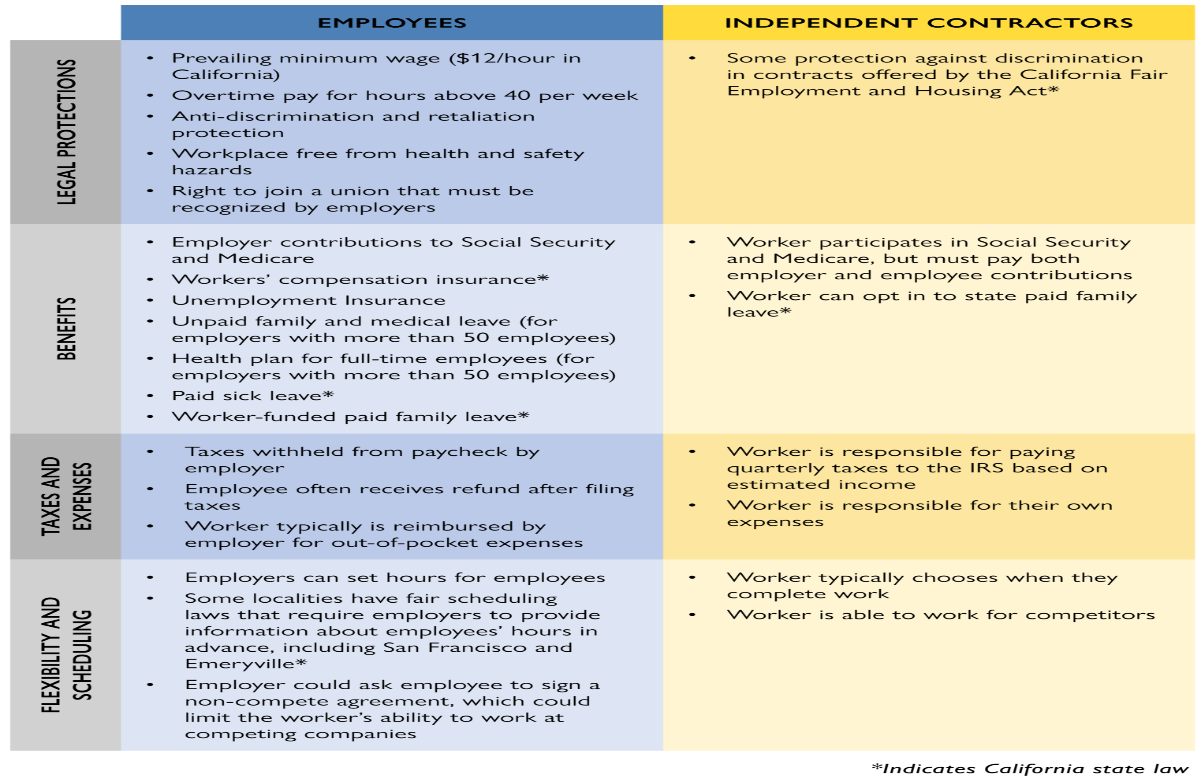

An Independent Contractor is defined differently under labor laws and the IRS code. If an employee derives a significant amount of income from one or two sources, they are not an independent contractor, under Federal Labor Laws. This is important to get right, because employees must be treated differently than independent contractors, and misclassifying someone as an independent contractor opens you up to liability for labor violations, and tax violations. There is a great chart on the differences between the employment conditions of an independent contractor and an employee at https://employment.findlaw.com/hiring-process/being-an-independent-contractor-vs-employee.html.

A house painter who paints your house and ten others that month, is an independent contractor. However, an employee who works 20 hours per-week taking photos for a commercial phot studio, and twenty-hours a week taking photos for a wedding photo company, is not an independent contractor in either job.

You have to ask, to tell whether the employee is an independent contractor, whether the employee is economically dependent on the job, if the employee is, then even if the employee has a second or third job, then they are not an independent contractor. The house painter paints countless houses and is not dependent on the income from any one house. The photographer derives half of his income from each source, and is, therefore, dependent on both, and is not an independent contractor. Even if a third job is obtained by the photographer, and the time every week is split evenly between the three jobs, the photographer is a part-time employee and not an independent contractor at all three jobs.

There is a six-factor test used by both the IRS and Labor Law. In Labor Law these six factors are relevant to the extent they prove the ultimate factor, whether the employee is economically dependent on the employer. If the employee is economically dependent on the employer, none of these six factors matter, except for the extent to which they prove economic dependence. These six factors are:

- The extent to which the services rendered are an integral part of the principal's business;

- The permanency of the relationship;

- The amount of the alleged contractor's investment in facilities and equipment;

- The alleged contractor's opportunities for profit and loss;

- The amount of initiative, judgment, or foresight in open market competition with others required for the success of the claimed independent contractor; and

- The degree of independent business organization and operation;

If an employee controls four of these factors, but derives most of their income from the employer, or a couple of employers, they are not an independent contractor for the purposes of Labor Law. For example, the photographer may use his own camera, and his own judgment on how to pose people in pictures, but he/she is still an employee because they are deriving the majority of their income from a limited number of sources with long term relationships. If someone is an employee, and not an independent contractor, they are protected by overtime laws, anti-discrimination laws, and ERISA, if applicable.

Basically, the IRS may consider these six factors determinative, but for labor law purposes you can only depend on them to the extent they prove or disprove economic dependence on the employer. An employee is treated totally differently from an independent contractor and entitled to all labor protections provided by the State and Federal governments. For a helpful list of some of the differences in how independent contractors are treated by the employer, and an employee is treated, see https://www.mbopartners.com/blog/misclassification-compliance/10-differences-between-independent-contractors-and-employees/.

So, the test is, if the employee was not employed by you, would their regular overall income substantially suffer? If the answer is yes, then the person is an employee who must be paid by W-2 and has all the protections of state and federal labor laws. If you are still confused there is a fun seven ways to tell if you are misclassifying a worker as an independent contractor, and while extremely simplified, incomplete, and not legally reliable, it will help you understand some of the basics. It is found at https://www.score.org/resource/7-clues-your-independent-contractor-really-employee-under-law.

Ultimately, you should consult an employment attorney to determine whether you are classifying employees properly. I have given a lot of the basics, and the test used by labor law, but sometimes this test can get confusing or ambiguous. There are a million exceptions that can be taken to the six factors, and an employment lawyer, is, really, the only one who will know if any of the exceptions apply, or if any additional factors apply, which would make someone an employee over an independent contractor.